From Cost to ROI: A Business Case for Adopting Warehouse Robotics ROI in 2026

For ages, investing in warehouse robotics ROI felt like a massive, prohibitive cost, a “big cap-ex” move reserved only for the industry’s titans. But that entire picture has flipped. With constant labor shortages, booming e-commerce, and everyone demanding instant delivery, automation isn’t just a nice-to-have anymore.

By 2026, it’s a non-negotiable competitive edge, shifting from an expensive luxury to a reliable, measurable return on investment (ROI) for any size of operation. This change is all thanks to mature tech, flexible setup options, and the clear business benefits that robotics deliver.

Warehouse Robotics ROI: Why 2026 is the Tipping Point

The current logistics environment is defined by volatility, making manual, labor-intensive operations structurally vulnerable. The confluence of these macro trends solidifies the urgent business case for adopting warehouse robotics now.

The E-commerce Volume and Velocity Crisis

Global e-commerce penetration continues its relentless ascent, necessitating a capacity for high-volume, high-velocity order fulfillment. Traditional warehouses struggle to keep pace, particularly with the proliferation of individual unit picks required for direct-to-consumer (DTC) sales.

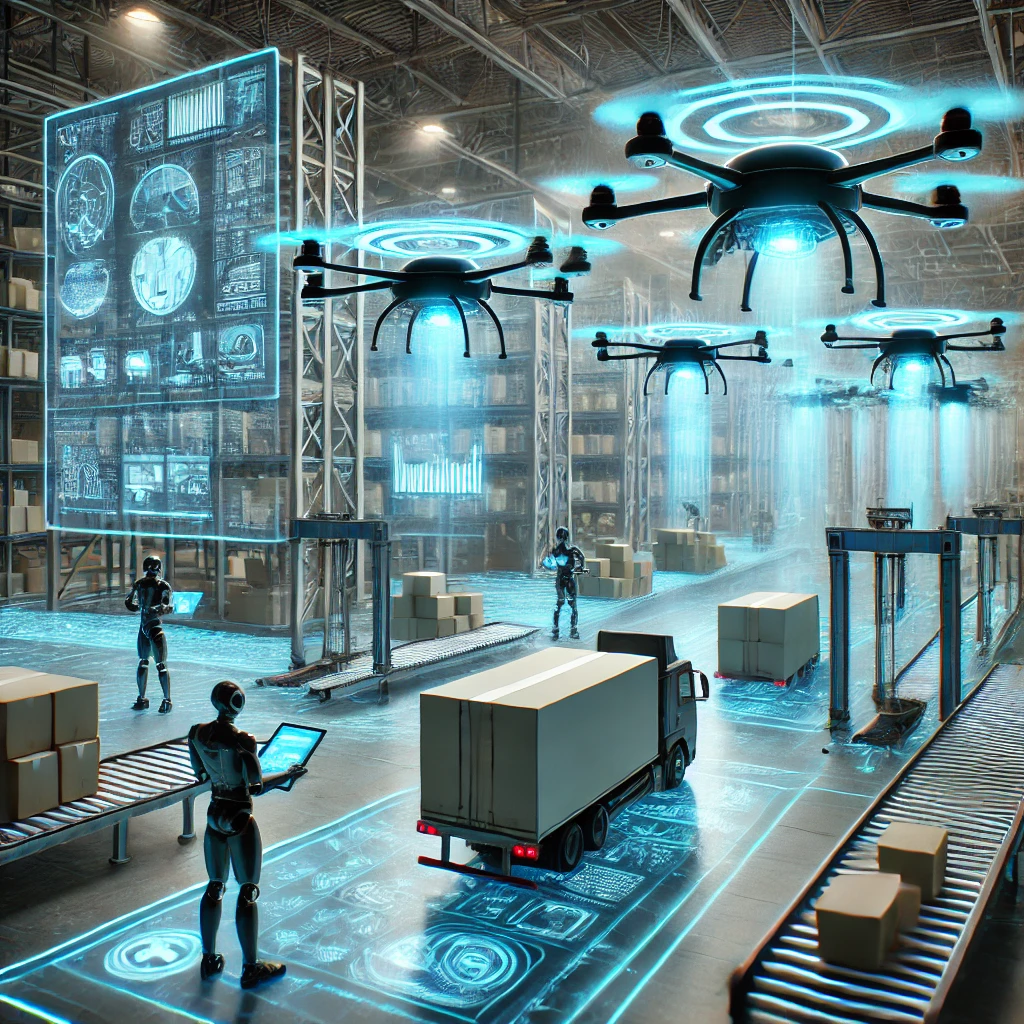

Robotics provides the throughput density and speed necessary to handle peak season spikes and meet demanding delivery windows without compromising accuracy. Automated storage and retrieval systems (AS/RS) and autonomous mobile robots (AMRs) can perform thousands of picks per hour, dramatically surpassing manual rates and ensuring that high fulfillment costs do not erode profit margins.

Persistent Labor Challenges and Rising Wages

The material handling industry faces a chronic labor shortage, worsened by high turnover rates and the physical demands of the job. For many warehouse operators, labor costs and availability represent the single biggest threat to profitability and operational stability.

Mitigating Wage Inflation: Robotics offers a predictable, fixed cost structure that insulates the business from escalating minimum wages and benefits.

Solving Availability: Robots, unlike human workers, are available 24/7. Integrating automation ensures that facility output remains consistent, eliminating the costly bottlenecks and delays caused by labor volatility and call-outs.

Focusing Human Capital: By taking over repetitive, strenuous, and ergonomically challenging tasks (like lifting and walking), robots free up the existing workforce to focus on higher-value activities such as quality control, exception handling, and process improvement ultimately increasing job satisfaction and retention among skilled employees.

Technological Maturity and Flexibility

The barrier to entry for warehouse automation investment is falling. Modern warehouse robotics ROI is faster to achieve due to key technological advancements like:

AMR Evolution: Today’s Autonomous Mobile Robots (AMRs) are highly intelligent, easily programmed, and require minimal infrastructure changes, allowing for phased deployment and lower initial capital outlay compared to rigid, track-based systems of the past.

Robotics-as-a-Service (RaaS): Flexible financing models like RaaS allow companies to adopt automation with operational expenditure (OpEx) budgets, leasing robots and associated software. This lowers the initial cost hurdle and aligns technology spend directly with the revenue generated, making the warehouse robotics ROI model immediately accessible to mid-sized and smaller operations.

Also See: Exploring Robotic Grasping Techniques for Optimal Inventory Handling

Throughput Capacity Increases Without Scaling Headcount

Traditional scaling requires more workers, supervisors, space, and equipment. Robotics, however, allow volume growth without needing to multiply staff. Fulfillment centers can process more orders per hour simply by increasing robotic fleet usage or extending operational hours. This means seasonal spikes become easier to manage. Instead of hiring dozens of temporary workers—often with inconsistent reliability—robots can take on the extra workload instantly. The result is smoother holiday fulfillment, fewer bottlenecks, and reliable delivery commitments. That consistency builds customer trust.

Energy Efficiency Outperforms Heavy Machinery

Forklifts and industrial equipment consume significant power. Robots, especially newer models, operate on energy-efficient motors and smart battery systems. Their charging cycles are optimized based on usage patterns, reducing unnecessary power draw.

Over months and years, operational energy savings become noticeable. Robotics also lowers maintenance expenses typical of heavier machinery. As a result, annual service fees, spare parts, and mechanical breakdowns become less prominent line items.

Energy efficiency is not just a sustainability bonus, it’s a cost-control mechanism.

Improved Safety of Warehouse Robotics Lowers Liabilities

Warehouse injuries are costly. Beyond medical bills, downtime, legal risk, insurance claims, and replacement labor all create financial drains. Robots dramatically reduce exposure to heavy lifting, repetitive stress, and collision-prone tasks.

By taking over hazardous activities, robotics reduce incident frequency. Safer environments produce more consistent productivity. Insurance premiums can decrease. Employees take fewer sick days. As a result, worker morale improves because fatigue and risk decline.

Safety becomes an ROI driver when framed as loss prevention rather than policy paperwork.

Real-Time Data Turns Operations Into Intelligence Systems

Modern warehouse robots collect live data as they move. They capture activity patterns, traffic bottlenecks, inventory heat maps, and pick frequency. This data feeds into analytics platforms that visualize how the warehouse behaves throughout the day.

Managers gain the ability to identify delays before they become costly. They can refine layout decisions based on real movement not assumptions. Reporting becomes insight-driven instead of manual guesswork.

Robotics shift operations from reaction to proactive optimization. That intelligence supports more strategic decision-making, unlocking gains beyond physical labor efficiency.

Scalability Protects Against Future Market Shocks

The past five years have shown how unpredictable supply chains can become. Companies relying on manual systems struggled to adapt to sudden spikes. Robotics provides flexible scalability.

If demand surges, additional robotic units can be deployed. Workflows adapt quickly through software updates, not construction or new hiring cycles. This adaptability builds resilience.

Planning against volatility is ROI by prevention. Companies avoid the financial instability that comes from being caught unprepared.

Warehouse Robotics ROI Maintenance Is Predictive, Not Reactive

Older warehouse equipment breaks down unexpectedly. By contrast, modern robotic systems self-monitor. They detect stress, track motor health, and signal when preventive service is required.

Predictive maintenance limits expensive downtime and avoids emergency repairs. Instead of halting operations, maintenance becomes scheduled, affordable, and controlled. A healthier fleet delivers continuous service with fewer disruptions.

Predictability leads to lower ownership cost across the machine lifecycle.

Customer Experience Becomes a Revenue Growth Engine

Fast and accurate order fulfillment does more than protect margins—it creates loyal customers. In competitive ecommerce, repeat buyers are the most profitable segment.

When robotics reduce mis-picks, shorten delivery windows, and improve inventory visibility, buyers notice. Retention increases, and referrals naturally occur. Customer satisfaction becomes a revenue driver, not a marketing expense.

Warehouses that consistently deliver reliability support stronger brand perception.

Conclusion

We’ve definitively moved past the point of viewing robotics as an expensive line-item and now rightly see it as a strategic asset. By 2026, warehouse operators won’t be asking themselves if they can budget for robots.

Instead, they’ll be calculating the potentially huge losses in market share and profitability they’ll face by ignoring the undeniable return on investment now available in warehouse automation. The message is clear and urgent. You must automate to survive and tap into data science to truly excel.